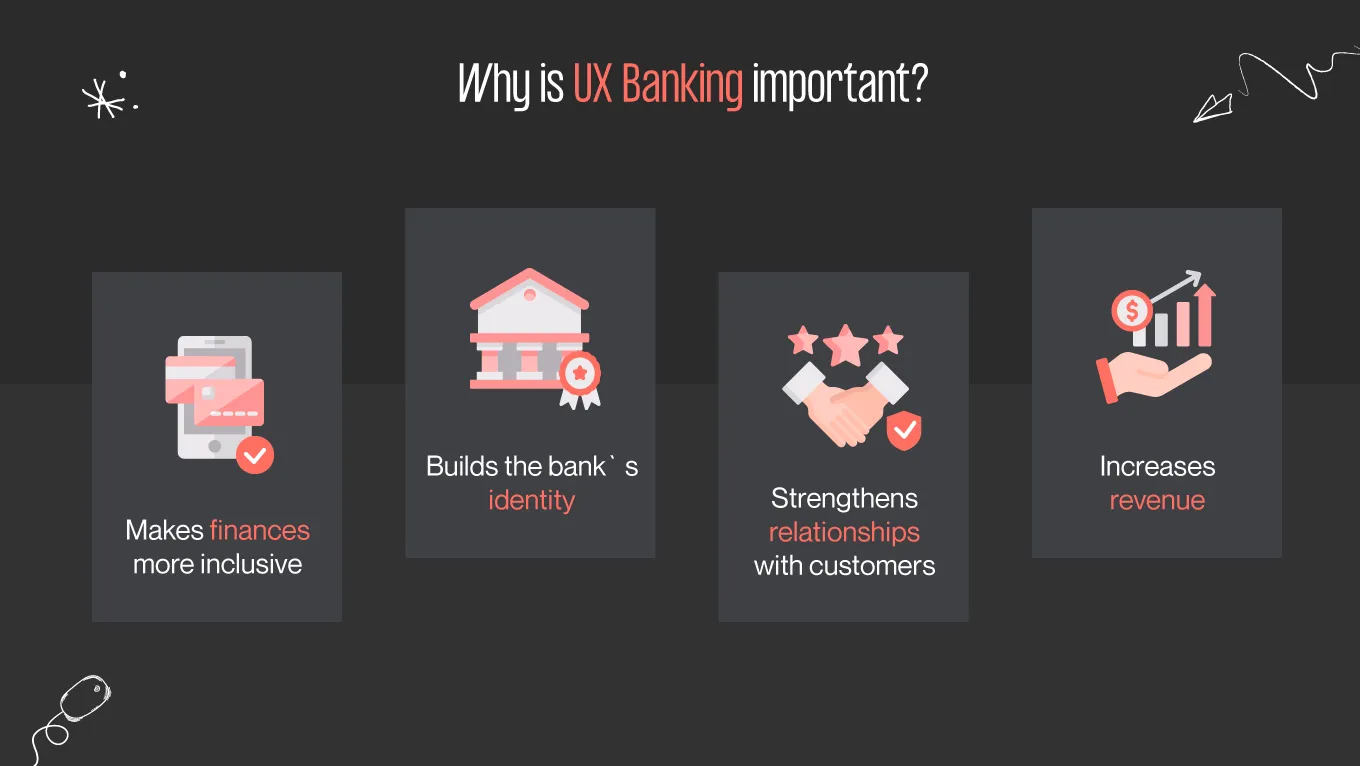

Industries today are thriving with online services, and banking is no exception. But what gives life to digital platforms? Elaborative banking UX design is critical. This is where you communicate with the customer, and it's in your best interest to make it evident. The experience your clients will get depends on the quality of your product, so it’s vital to pay enough attention to developing an excellent online platform. 90% of users stopped using a service due to poor performance. Based on this, you can ensure UX design is part of your success.