Avoid the lengthy read and get straight to the point with this summary of cryptocurrency exchange software development costs brought to you by Gapsy Studio. Creating a crypto trading app or software can range from $30,000 to $1,50,000 while opting for a White Label version of a well-known crypto application could set you back around $25,000.

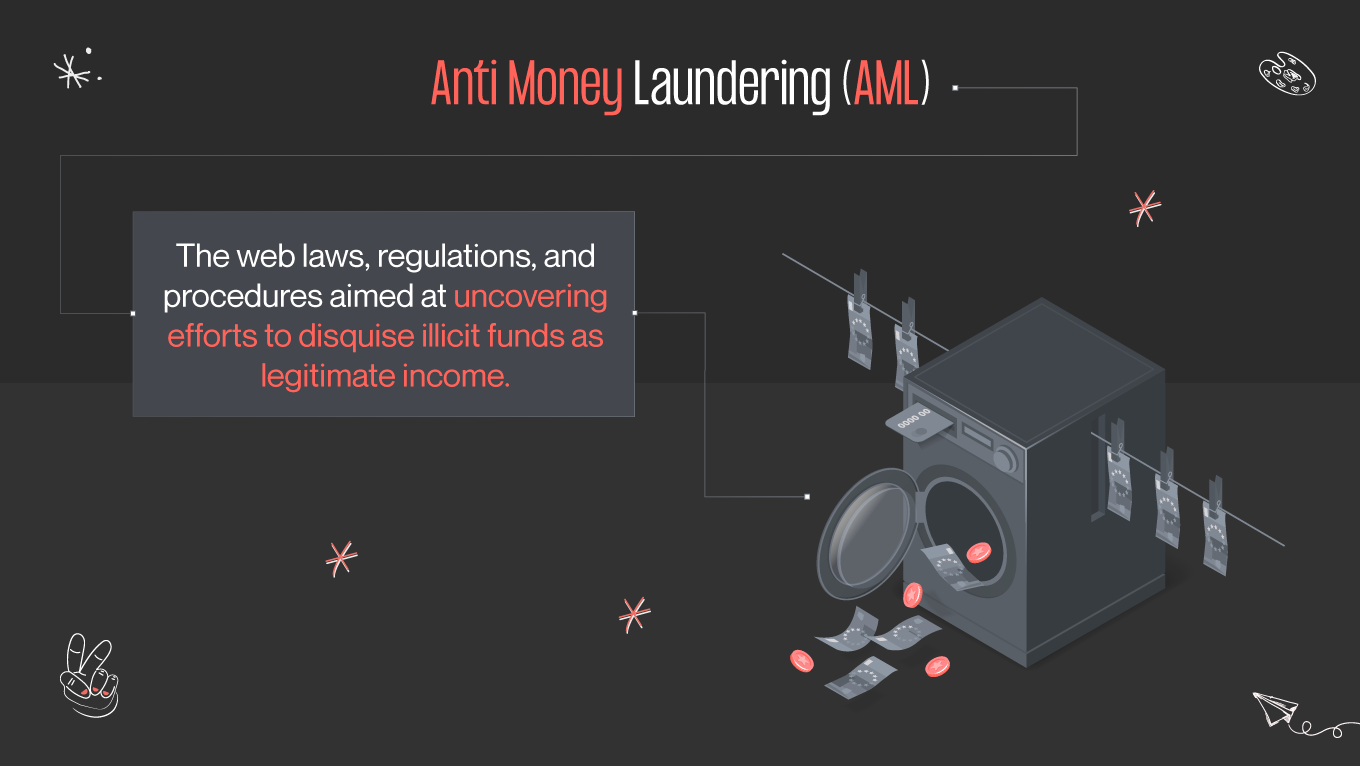

But what influences these crypto exchange development costs? Numerous factors come into play, including the app's complexity, the variety of features it offers, and the geographical location of the development team.

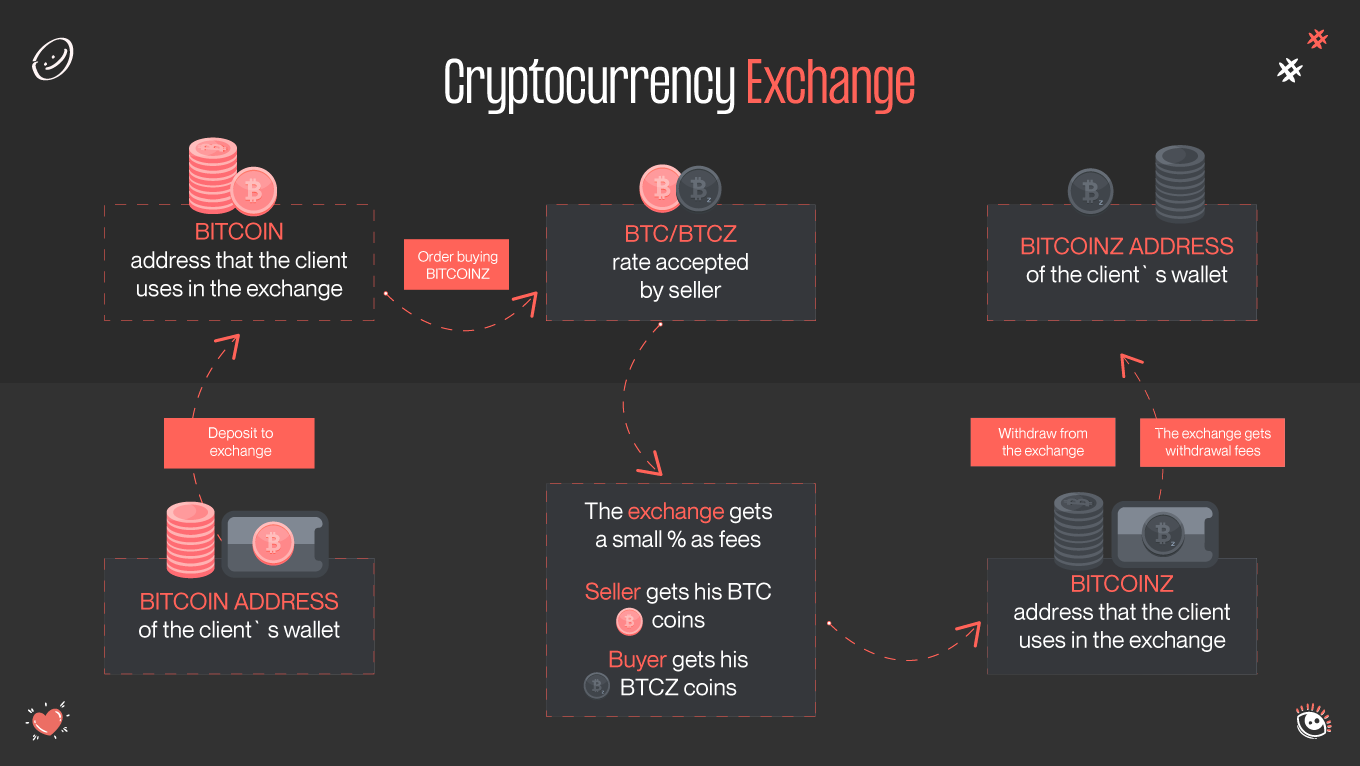

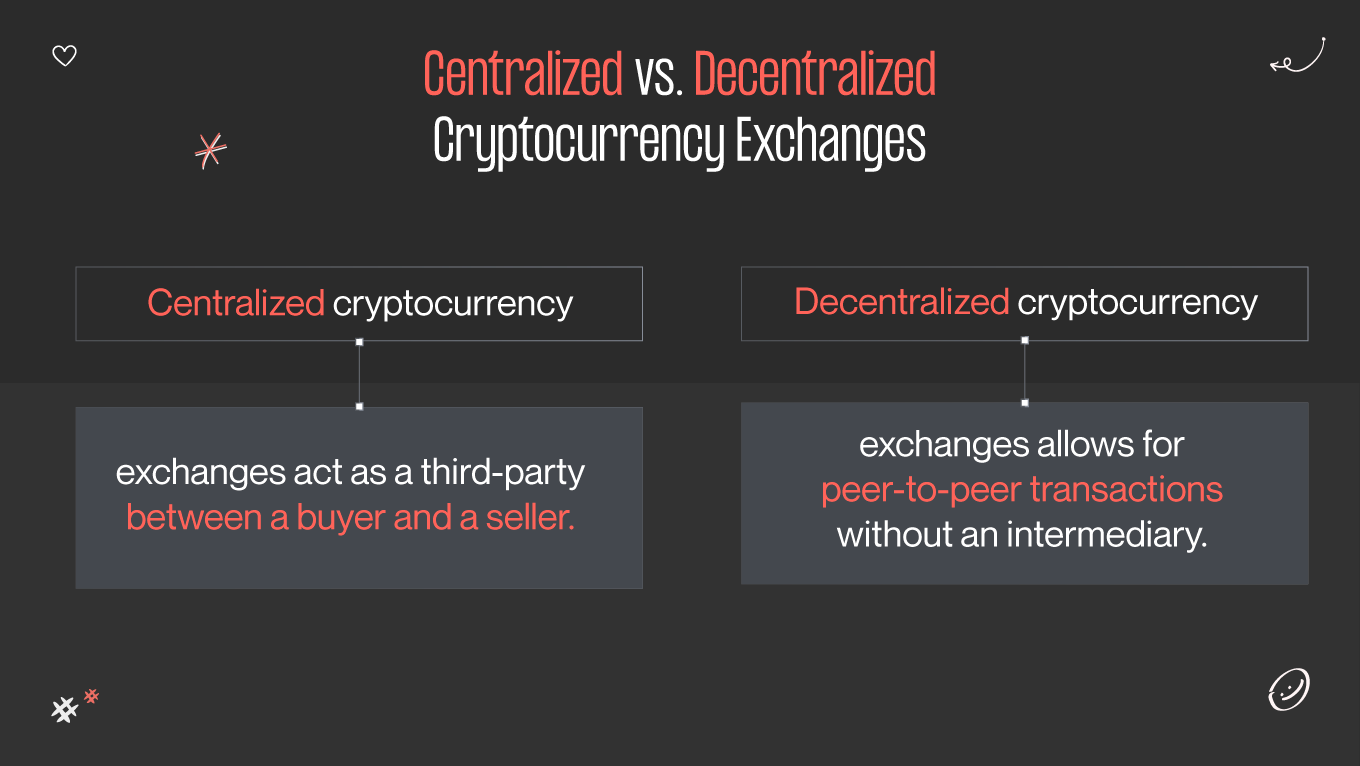

With millions of users worldwide, cryptocurrency has captured the attention and imagination of the global population. The peak in digital currency usage has made crypto assets generated through decentralized blockchain technology more relevant than ever. This has resulted in a surge of crypto exchanges, creating opportunities for entrepreneurs and established businesses to tap into the cryptocurrency exchange market. Before delving further into this article to uncover the intricacies of crypto exchange development costs, Gapsy Studio highlights some critical factors to consider.