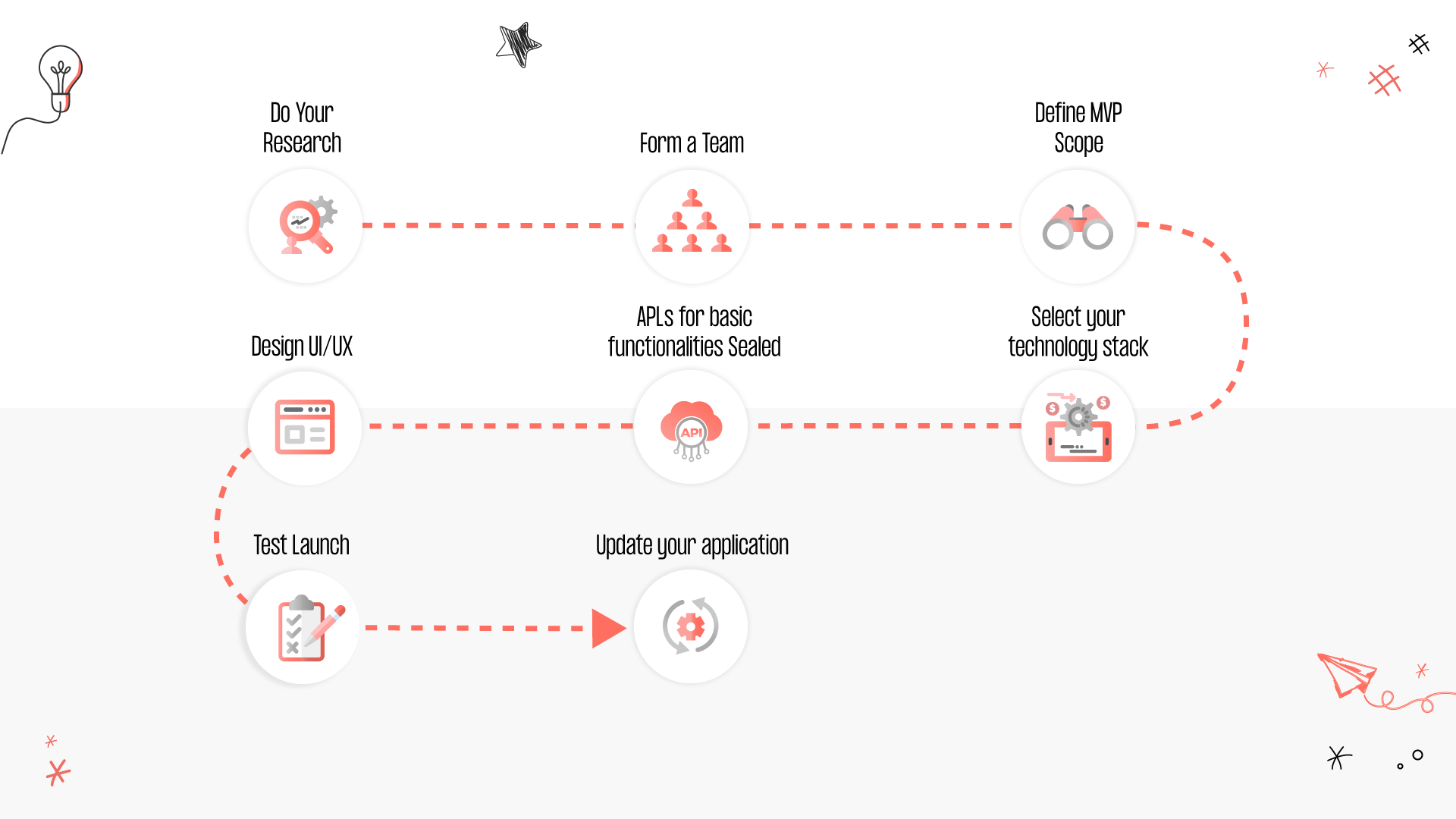

In the modern world, technologies are changing how companies manage and process financial data. Fintech applications have become an integral part of how businesses run their operations and how customers interact with them. Building a fintech app requires careful planning and execution, as it must adhere to regulatory requirements while providing helpful user functionality. This article will discuss building a fintech app, from ideation and planning to development and testing. By following these steps, you can ensure that your product will be made correctly and securely.