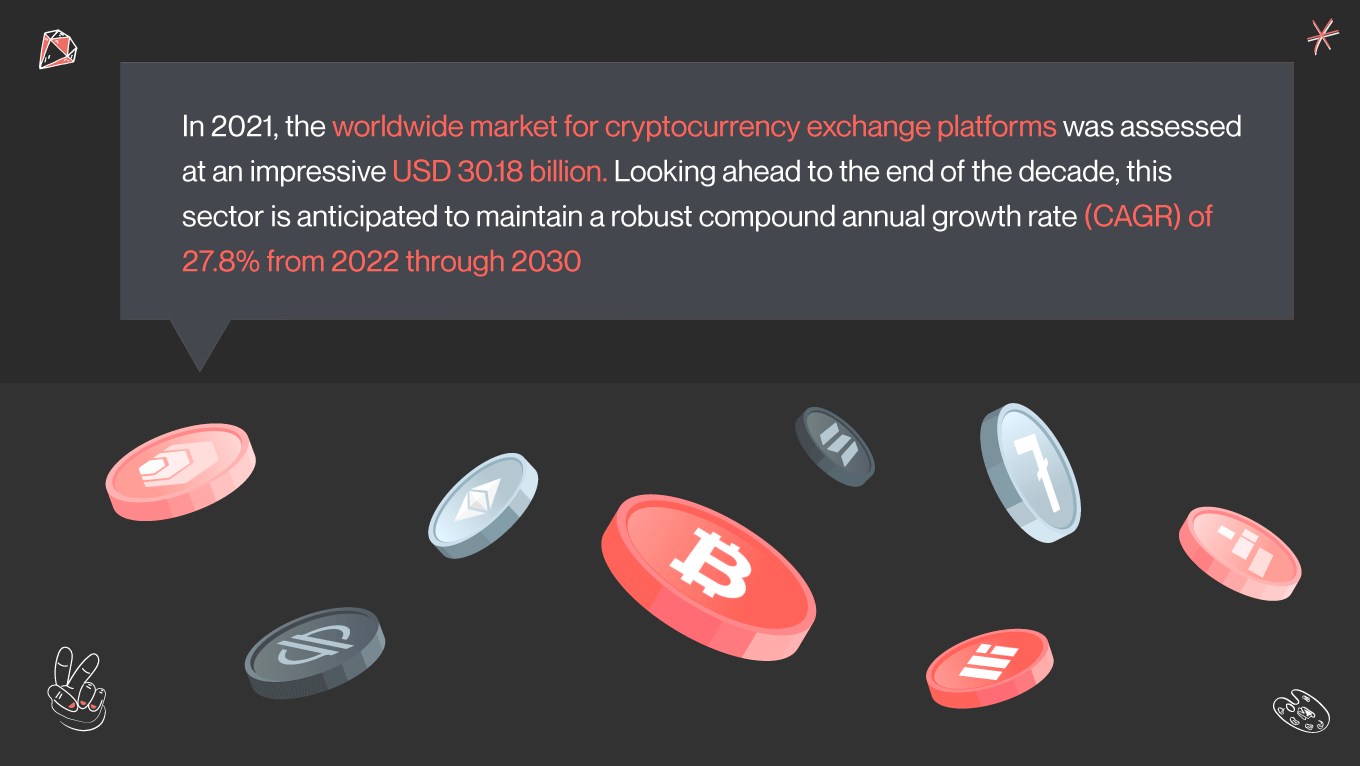

The statistics speak volumes: the burgeoning market, with millions of global users and a growing number of businesses accepting cryptocurrency, is on an undeniable upward trajectory. While providing unprecedented opportunities, this digital currency ecosystem demands sophisticated platforms that can cater to the needs of a diverse user base ranging from crypto novices to seasoned traders.

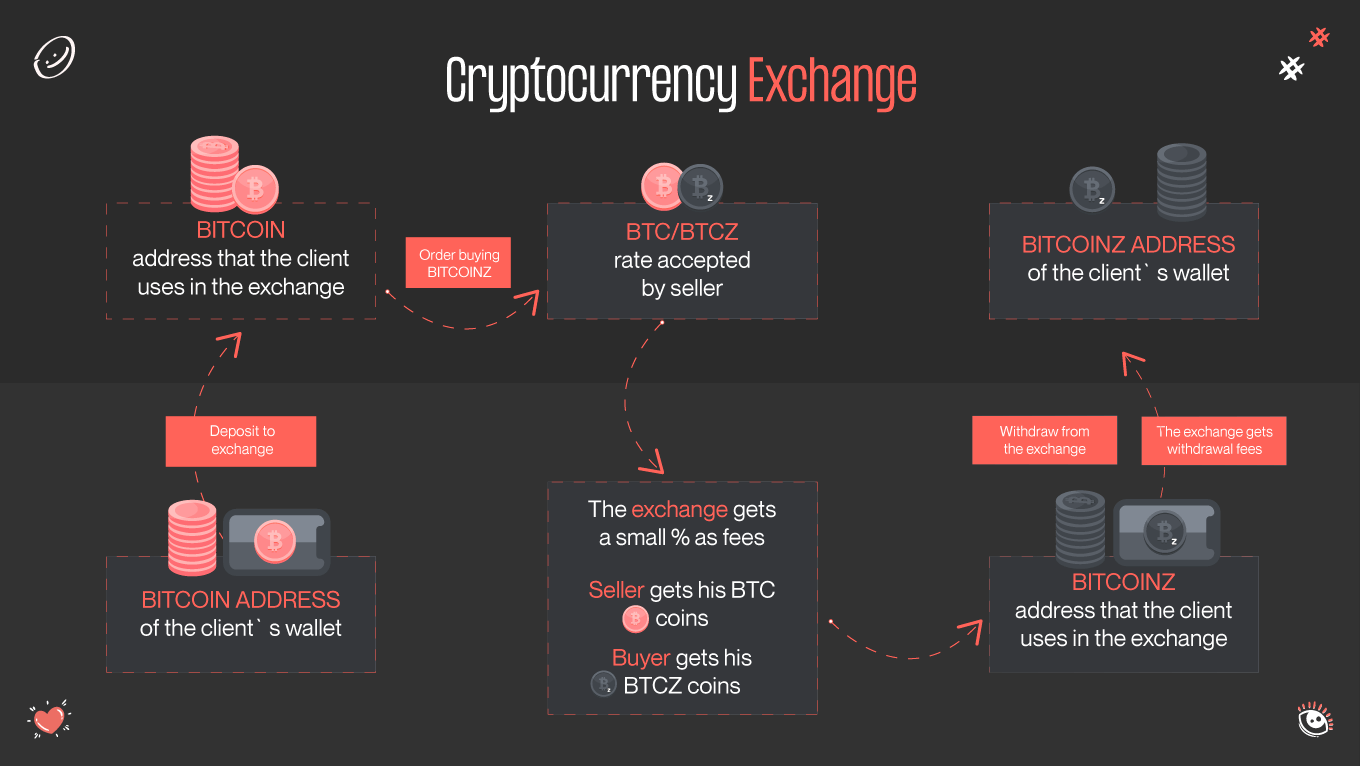

This article will unfold the blueprint for developing a cutting-edge crypto exchange app. We will delve into the critical steps, essential features, and industry best practices that come together to create a platform capable of standing out in a competitive market. So, whether you're contemplating how to create a crypto exchange app that simplifies trading for newcomers or developing an advanced ecosystem for veteran investors, Gapsy Studio's expertise is your gateway to realizing those aspirations.

Let's embark on this journey together, unraveling the complexities of developing a crypto exchange app and setting the stage for a project poised to make waves in the digital currency domain.