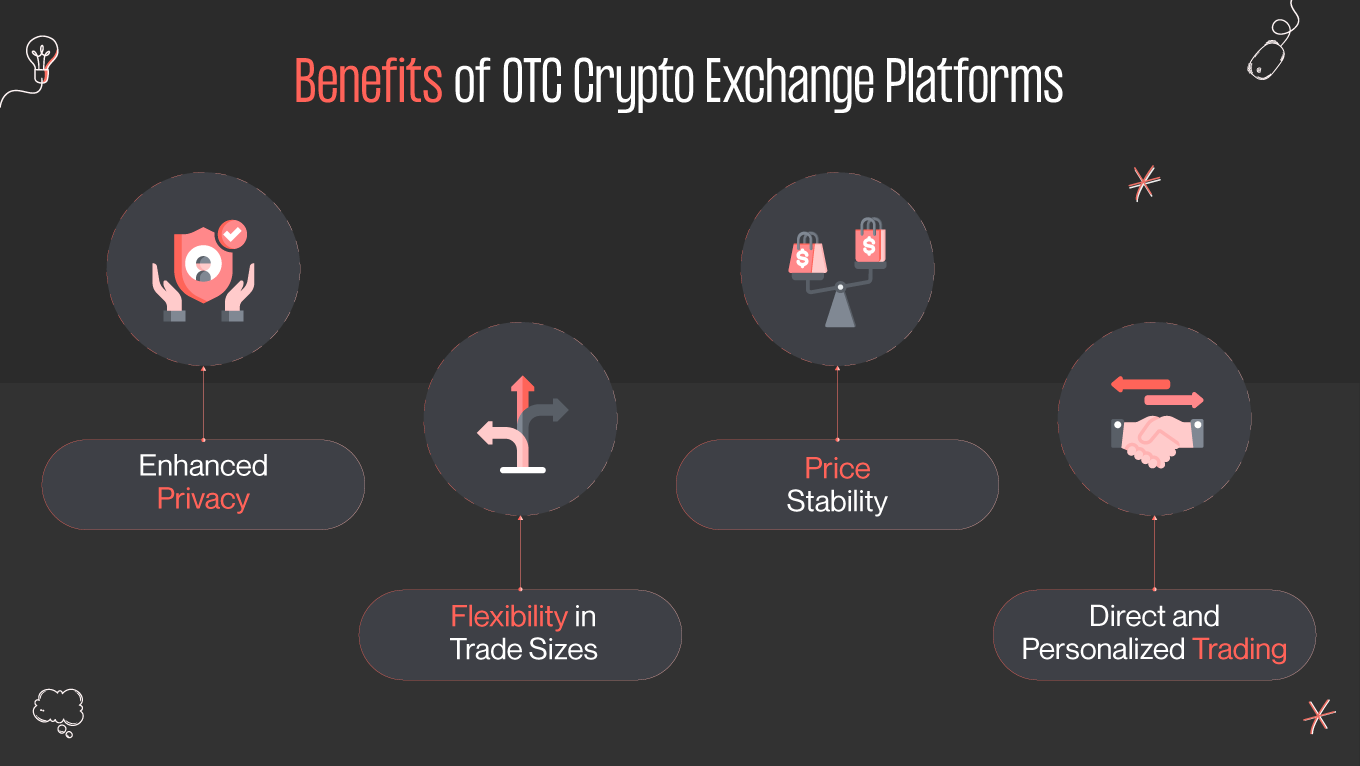

In today's dynamic cryptocurrency market, which is witnessing unprecedented growth, business professionals are increasingly turning towards trading platforms. We have the ideal solution if you're an investor looking to dive into the trading domain with a modest initial investment. Our top-tier OTC crypto exchange script is crafted to assist you in generating passive income streams. Imagine learning about the nuances of building an OTC exchange, its unique architectural design, and its functional mechanisms.

Leading the way in OTC crypto exchange development, our skilled team excels in providing top-notch, secure, and cost-efficient OTC crypto exchange software scripts. Customized with additional functionalities, these scripts are specifically designed to align with the distinct requirements of your business venture. Let's explore…