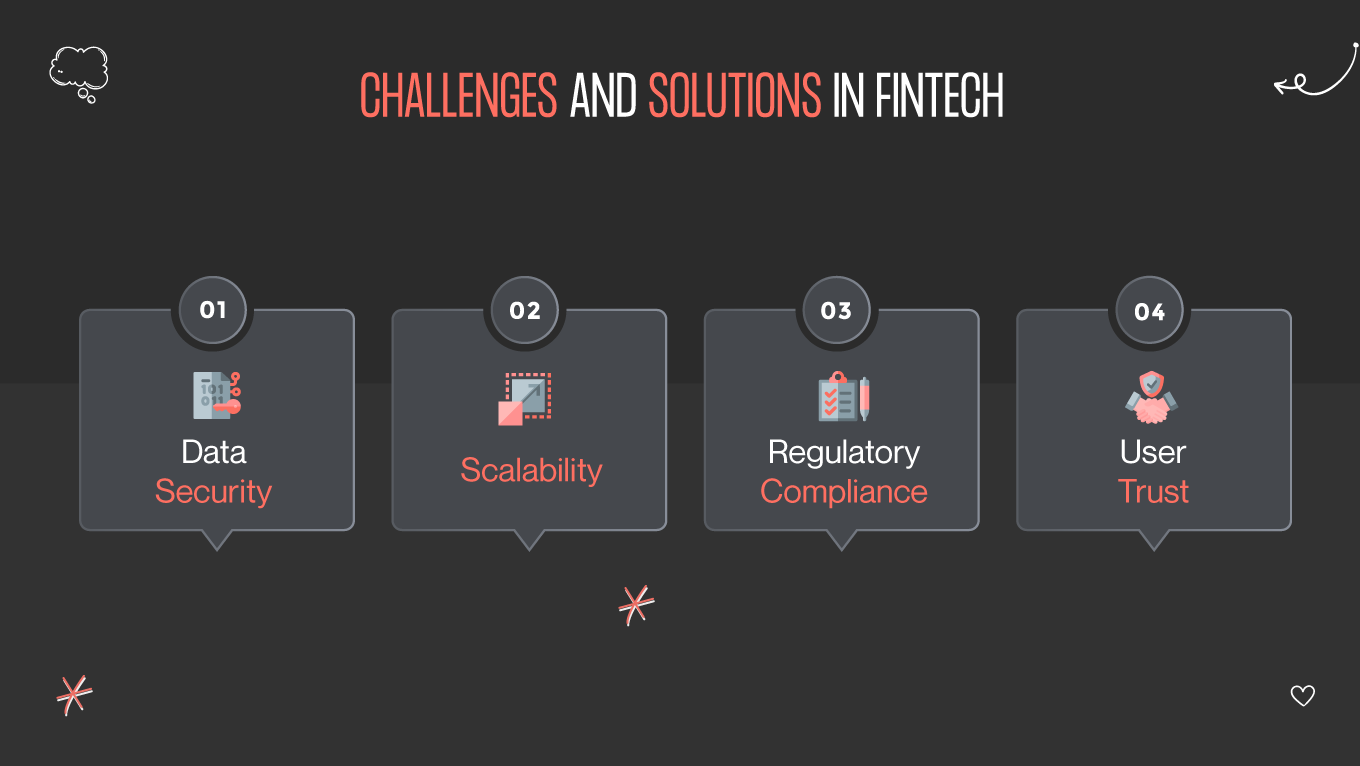

In a world where technology is ceaselessly transforming our daily lives, the fusion of innovation and creativity has never been more relevant. One area where this amalgamation creates seismic shifts is financial technology, more commonly known as fintech.

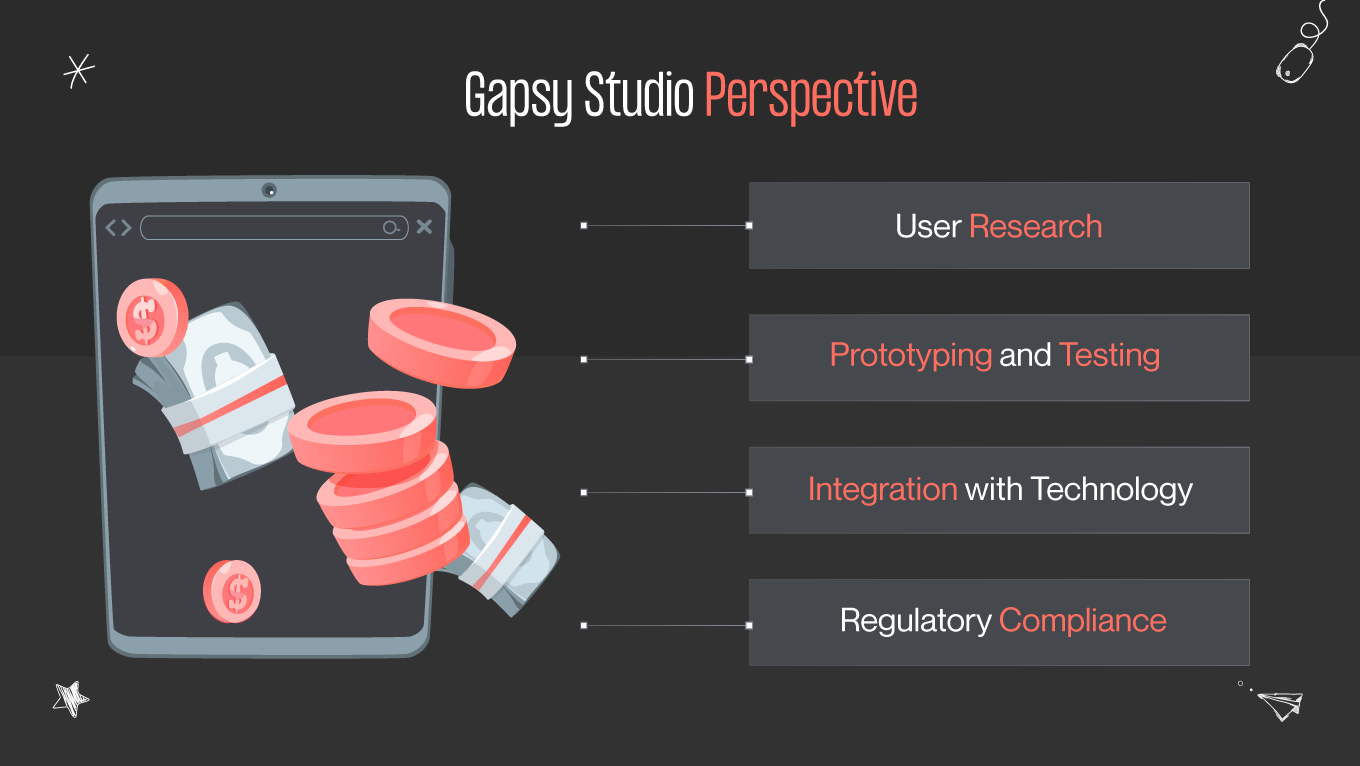

Design thinking isn't a new concept, but its application within fintech is crafting a paradigm shift worth exploring. Design thinking, at its core, is a user-centered approach that emphasizes empathy, collaboration, and iterative design. Its purpose is to address complex problems with innovative solutions focusing on the human experience.

So, what happens when you merge this human-centric methodology with the ever-evolving fintech landscape? A revolution, that's what! Design thinking in fintech is not just enhancing the way financial services are delivered; it's redefining the very fabric of the industry.

In this article, we will delve into the intricate dance between design thinking and fintech. We'll explore how this partnership is breaking down traditional barriers, creating more intuitive user experiences, and ushering in a new era of financial empowerment.

Let's get started, shall we? The future of finance is here, and it's more creative, inclusive, and groundbreaking than ever. Join us as we uncover how design thinking fintech is changing the game!