Look at the numbers from 2025: DEXs aren't just a niche anymore. Capturing nearly 22% of total volume and surging in the perpetuals market means the Trust-Liquidity Paradox has finally hit a breaking point. Traders want that snappy, Binance-style execution, but they’re done with the "black box" risk of handing over their assets. They want both CEX speed and their own keys.

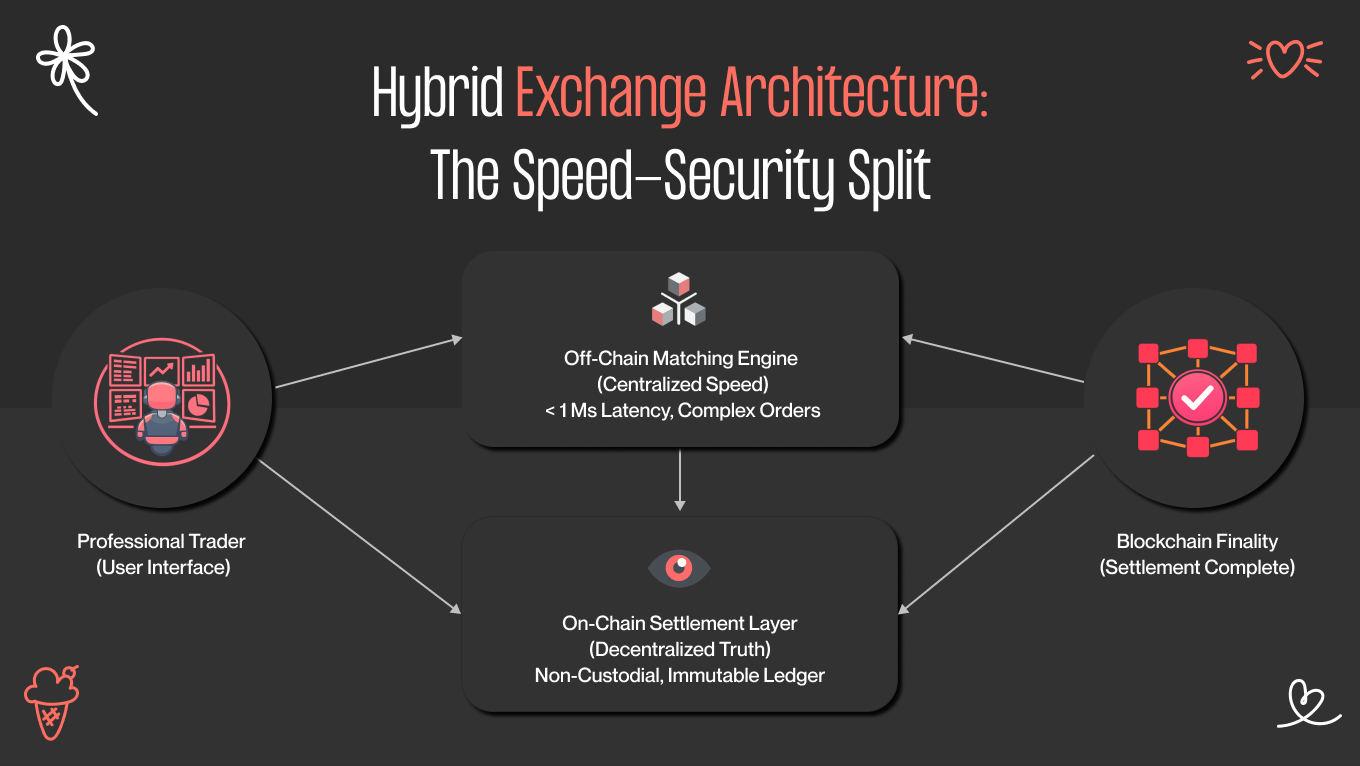

Our fintech design studio sees founders stop trying to pick a side in the CEX vs. DEX war. Instead, they’re moving toward hybrid crypto exchange development. It’s a smart architectural play. You match orders off-chain so the platform is fast enough for professional scalpers, but you settle everything on-chain so the exchange never touches the money. From a business perspective, this effectively kills your custodial liability and drastically lowers insurance and legal overhead.

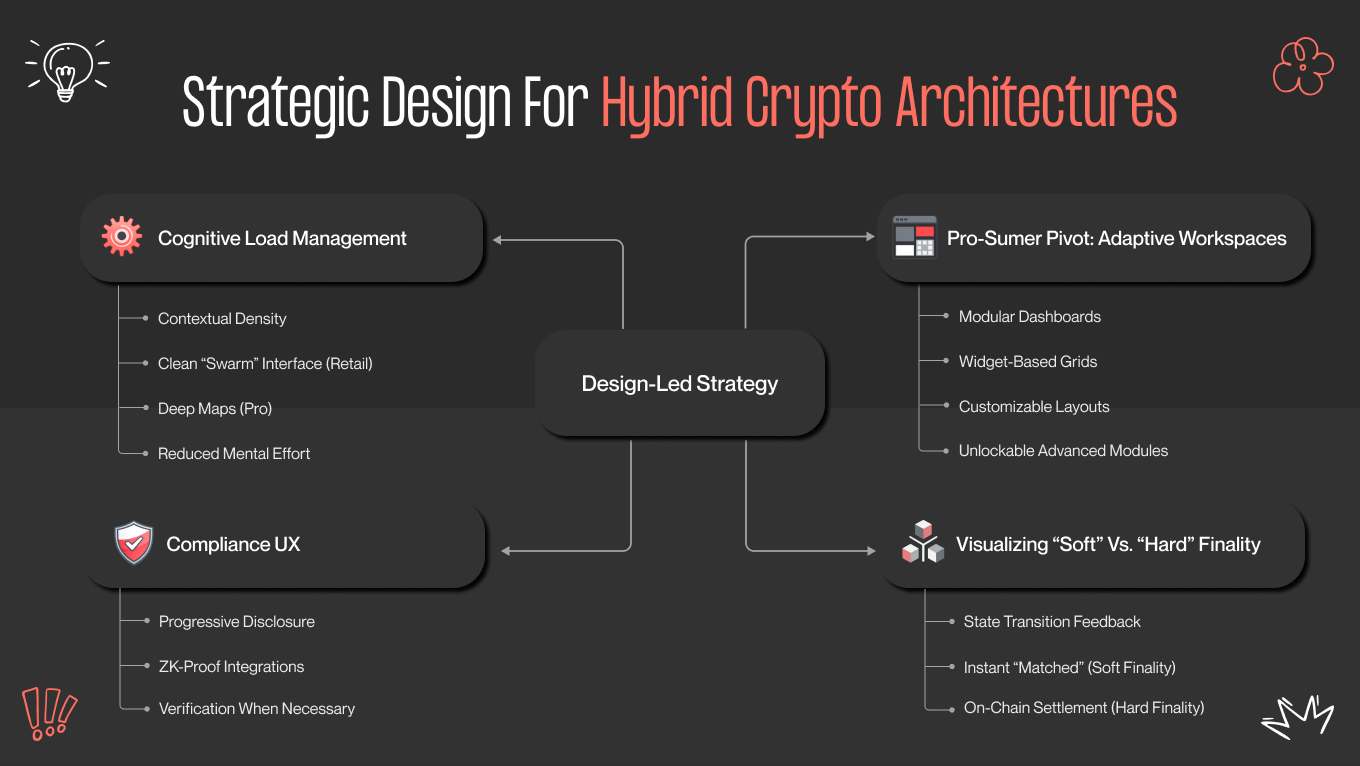

But here is the catch: if you build a hybrid exchange that feels like a clunky DeFi experiment, your users will leave before their first trade settles. In this guide, we’re skipping the fluff to look at the actual mechanics of building a market leader in 2026. We’ll show you how we design around the liquidity desert using aggregation and how to bake in heavy-duty tech like MPC and ZK-proofs without making the UI feel like a cockpit from the 90s.