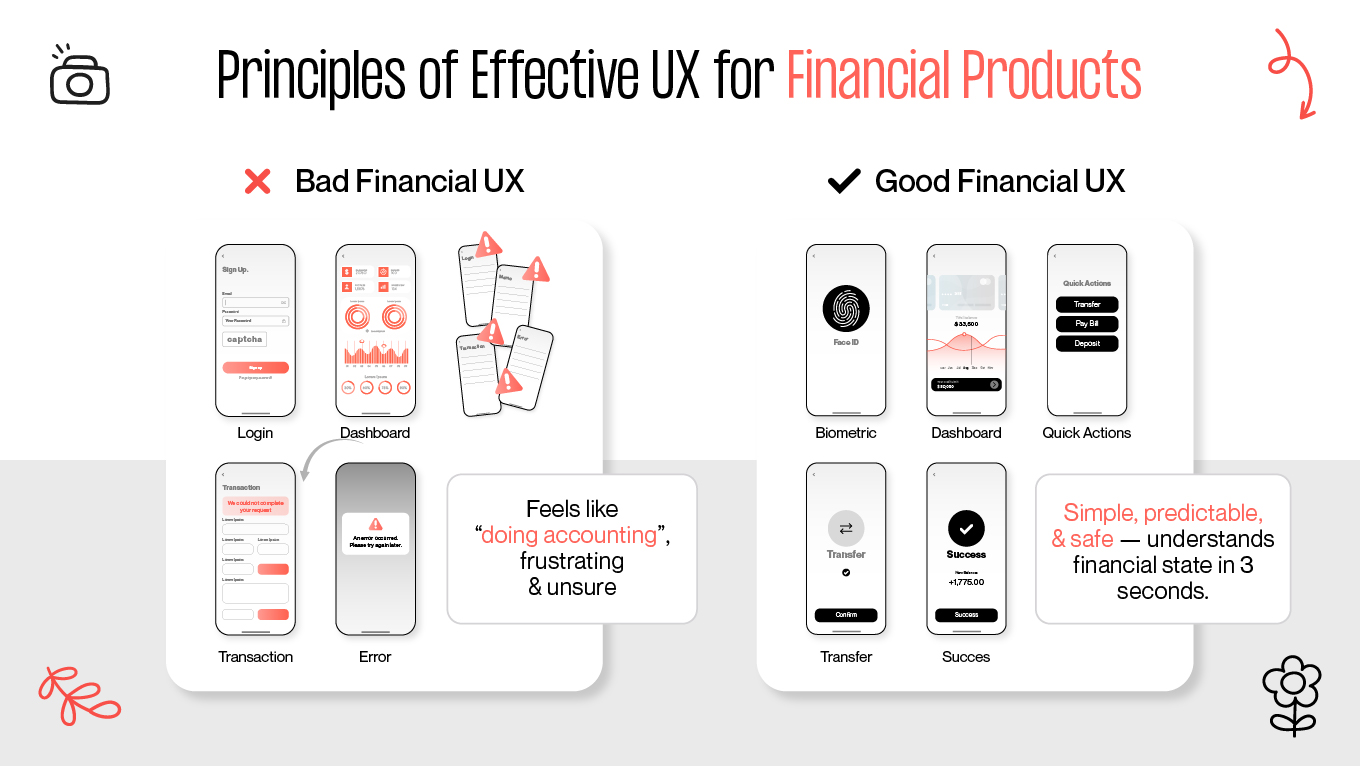

In finance, users are far less forgiving of products that make money feel complicated. While financial services account for nearly a quarter of the global economy, a critical gap remains: most digital products fail to translate complex backend logic into a language people understand. This "complexity tax" is expensive. Statistics show that over 70% of users abandon fintech apps within the first 30 days, even after a successful onboarding. This is a failure of the experience.

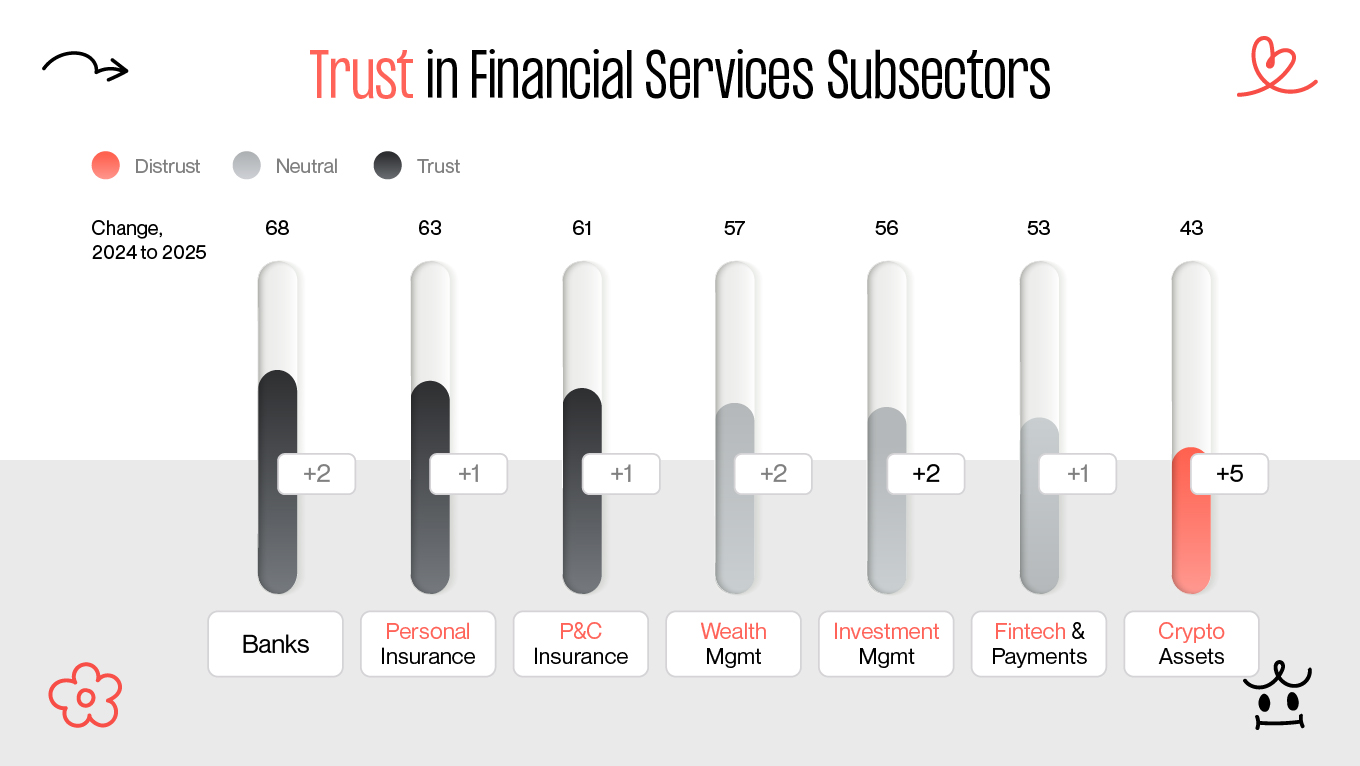

People turn to fintech to solve high-stakes problems: moving savings, analyzing balances, or making split-second investment decisions. In these moments, clarity is a prerequisite for confidence. When an interface feels overwhelming, the psychological contract of trust breaks instantly. This is why high-quality UX design in financial services is a business requirement that directly dictates retention.

Our work with fintech platforms has proven that engagement is a byproduct of simplicity. By distilling dense data into intuitive decision paths and cleaner flows, we help brands move from being a "tool" to becoming a trusted financial partner. In this article, we’ll unpack the core principles of UX in finance: the design techniques that transform complex numbers into human, usable, and high-performing interfaces.