In fintech, design is strategy in disguise. Every screen, click, and micro-interaction shapes the way users perceive trust — and trust is currency in digital finance. Yet, too many products still fail where it matters most: the first impression. For example, 60% of fintech users abandon transactions mid-process due to poor onboarding UX.

For a growing fintech company, this can be a growth limiter. A confusing verification flow, an overloaded dashboard, or inconsistent data visualization can drain acquisition budgets and dilute user loyalty. The truth is, the difference between a fintech app that scales and one that stalls often comes down to whether the design process considers how people experience finance online.

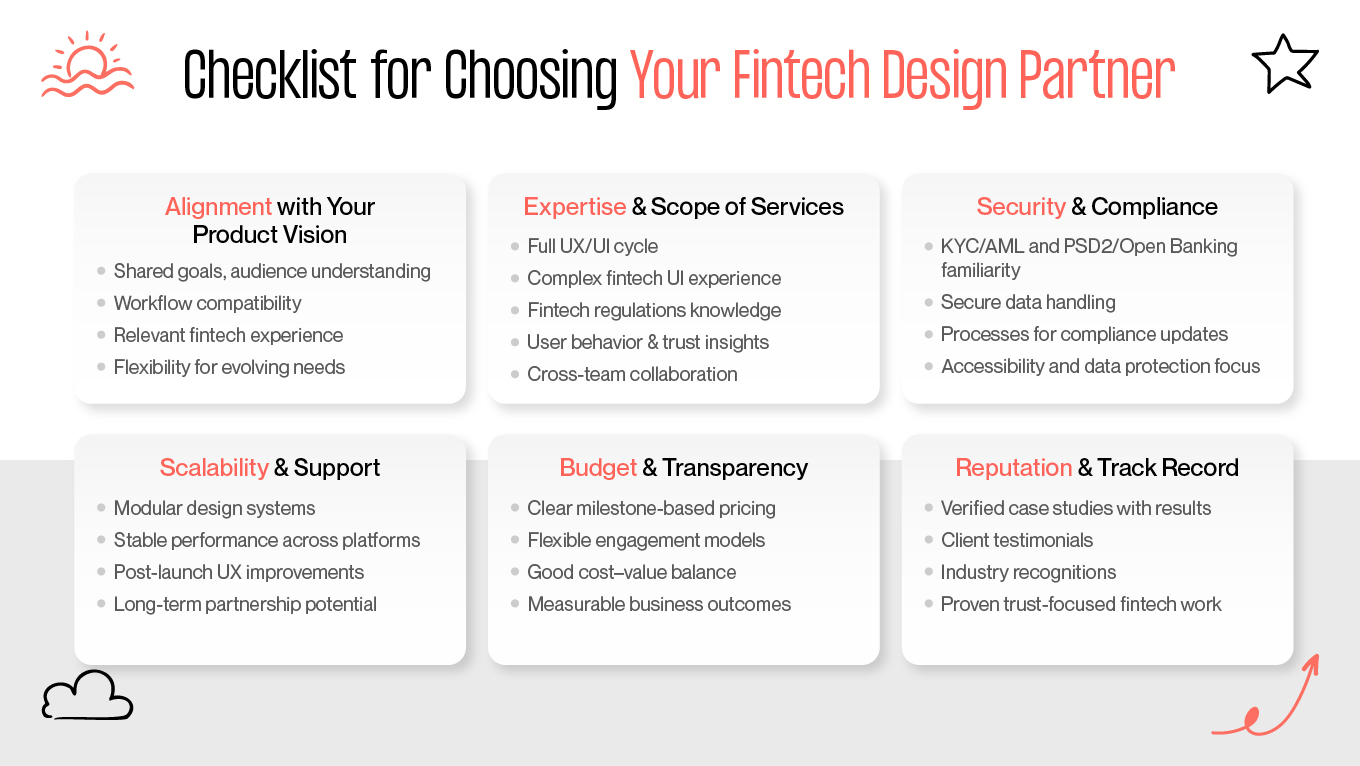

That’s why choosing a fintech design agency is less about outsourcing visuals and more about finding a long-term product partner. A team that understands compliance and user psychology, collaborates with developers seamlessly, and helps transform complexity into clarity.

In this article, we spotlight ten fintech design agencies that have proven they can do exactly that. These are teams known for pairing creative excellence with strategic discipline.